Hiring in the US surged in November, continuing a prolonged streak of job gains that has strengthened the world's largest economy. According to the latest report from the Labor Department, employers added 227,000 jobs, with significant contributions from healthcare firms, restaurants, and bars.

This marked a strong recovery from October, when job growth slowed sharply due to disruptions caused by major storms and labor strikes. The report comes as analysts closely watch the Federal Reserve’s potential moves on interest rates in the coming months.

Interest Rate Decisions in Focus

The Federal Reserve began lowering interest rates in September, citing the need to support economic growth and mitigate potential weaknesses in the labor market. In October, however, job growth stagnated as strikes at companies like Boeing and severe hurricanes left millions temporarily out of work.

The November rebound, coupled with upward revisions to hiring figures for October and September, suggests the earlier slowdown was largely temporary. Despite this positive news, many analysts anticipate the Federal Reserve will announce another rate cut when it meets this month, driven in part by a slight increase in unemployment.

Unemployment and Wages

The unemployment rate edged up from 4.1% to 4.2%, reaching its highest level since August. However, Federal Reserve Chairman Jerome Powell has downplayed the urgency of further rate cuts, emphasizing the economy’s robust performance.

"The economy is growing steadily, with near-full employment and consistent wage growth," noted Richard Flynn, managing director at Charles Schwab UK. "For now, the macroeconomic outlook is positive, and market sentiment reflects that optimism."

Balancing Growth and Inflation Risks

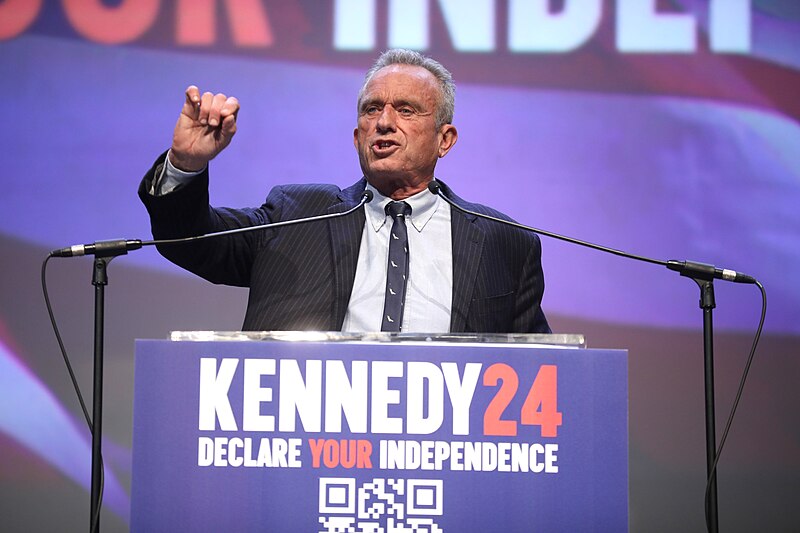

Diane Swonk, chief economist at KPMG US, highlighted the challenges facing the Fed, especially with the uncertainty surrounding President-elect Donald Trump’s proposed tax cuts and tariffs. Over the past year, average hourly wages have risen by 4%, prompting concerns about potential inflation.

"The Fed has signaled a slower pace for rate cuts due to the economy's strength," Swonk said. "The resilience of the labor market underscores the ongoing challenge of managing inflation."

While uncertainties remain, the November job growth reinforces confidence in the US economy’s resilience, even amid external shocks. The Federal Reserve’s cautious approach reflects the delicate balance between fostering growth and controlling inflation. Photo by Phil Whitehouse, Wikimedia commons.