Former President Donald Trump has unveiled plans for a Crypto Strategic Reserve, a national stockpile of digital assets aimed at bolstering the industry after what he described as

"years of corrupt attacks." He announced on Sunday that his administration has been directed to move forward with establishing the reserve, which will include cryptocurrencies such as XRP, Solana, and ADA.

In a follow-up statement, Trump clarified that Bitcoin and Ethereum would be the “heart of the Reserve,” emphasizing his strong support for the two leading cryptocurrencies.

The Executive Order Behind the Move

Trump’s announcement builds on an executive order he issued on January 23, which instructed his administration to form a working group to develop a regulatory framework for digital assets. This order also included an initiative to explore a “national digital asset stockpile.”

How Did Crypto Prices React?

The crypto market responded swiftly to Trump’s announcement:

Bitcoin surged over 10%, surpassing $94,000 on Sunday afternoon.

Ethereum jumped more than 13%, briefly exceeding $2,500.

Smaller cryptocurrencies mentioned in the reserve—XRP, ADA, and Solana—spiked at least 20% following the news.

What Would a ‘Crypto Strategic Reserve’ Look Like?

While details remain uncertain, Trump’s executive order suggests the reserve could be built using cryptocurrency already seized by the federal government through law enforcement actions.

According to The New York Times, the U.S. government holds an estimated $19 billion in Bitcoin, which it could retain instead of periodically selling, as it has done in the past.

The Washington Post noted that previous government sell-offs have historically caused crypto prices to decline—holding onto these assets instead could prevent market disruptions.

It remains unclear if Trump’s administration will actively acquire additional cryptocurrencies, a move that could significantly boost the industry but might require Congressional approval.

Criticism and Concerns

While crypto advocates have welcomed the idea of a national stockpile, economists have raised concerns about the proposal:

Critics argue that crypto’s volatility makes it a risky government investment that could lead to billions in taxpayer losses if the market declines.

Mark Zandi, chief economist at Moody’s Analytics, called the idea unjustified, saying:

“I get why the crypto investor would love it. Other than the crypto investor, I don’t see the value, particularly if taxpayers have to ante up.”

Why Do Crypto Supporters Want a National Stockpile?

Proponents believe a Crypto Strategic Reserve could benefit the industry and even the broader economy:

Government-held crypto assets could appreciate over time, increasing federal revenue.

Prevents sell-offs that could cause market instability.

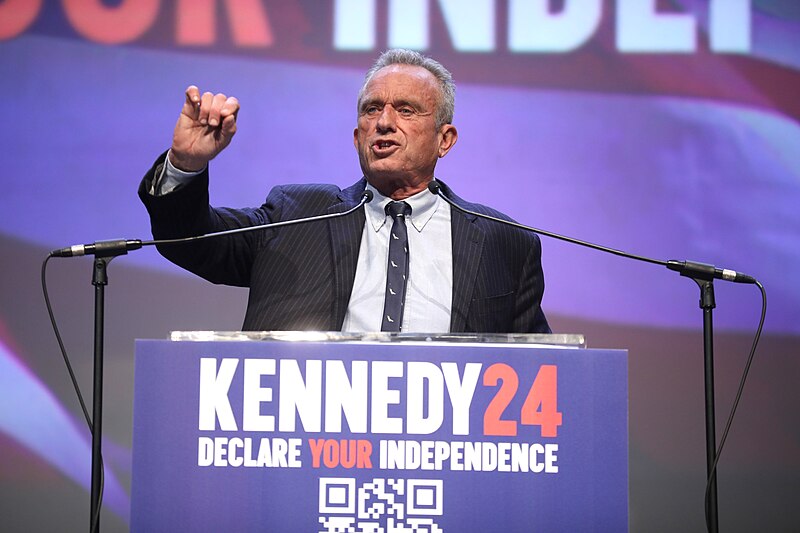

Some, like Sen. Cynthia Lummis (R-Wyo.), argue that Bitcoin could be used as a “savings technology” to reduce the national debt.

Lummis introduced a bill in July proposing a national Bitcoin stockpile, claiming it could cut U.S. debt in half.

The Tether Controversy

Trump’s announcement notably excluded Tether (USDT)—a stablecoin pegged to the U.S. dollar—even though some of the government’s seized assets include Tether.

This omission has raised questions, especially given that Commerce Secretary Howard Lutnick has ties to Tether:

Cantor Fitzgerald, the company Lutnick previously led, reportedly helps oversee Tether’s portfolio and recently struck a deal that could give it a 5% stake in Tether.

Lutnick has since resigned and pledged to divest from Cantor Fitzgerald, but some Democrats remain skeptical.

Sen. Elizabeth Warren (D-Mass.) has publicly expressed concerns, warning that Lutnick’s new role could influence policies impacting Tether and the broader crypto industry.

The White House and Commerce Department have not commented on whether Lutnick will be involved in the Crypto Strategic Reserve.

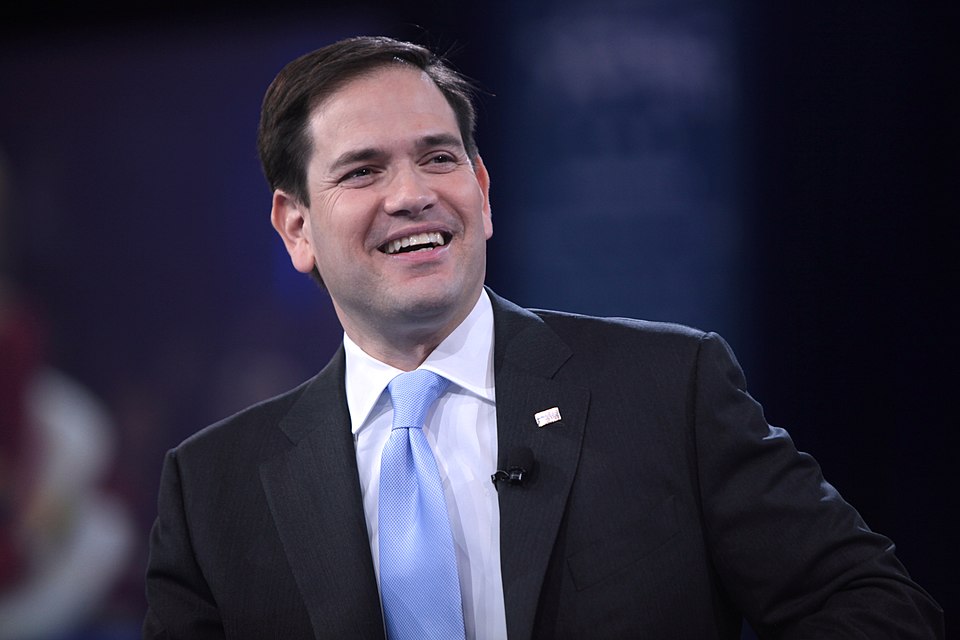

Trump’s Crypto-Friendly Stance

Trump has positioned himself as a major crypto advocate, a shift from his previous skepticism. In the lead-up to the November election, he:

Pledged to deregulate the crypto industry and lower interest rates.

Called for all remaining Bitcoin mining to be U.S.-based.

Promised to never sell government-held Bitcoin, declaring at a July conference:

“For too long, our government has violated the cardinal rule that every Bitcoiner knows by heart: Never sell your Bitcoin.”

Beyond rhetoric, Trump has also taken proactive steps in office:

Created a “Special Advisor for AI and Crypto” position, filled by ex-PayPal COO David Sacks.

Rescinded Biden-era crypto regulations.

Appointed Paul Atkins, a well-known crypto supporter, to lead the Securities and Exchange Commission (SEC).

Trump even entered the crypto space himself, launching his own $TRUMP meme coin ahead of his inauguration.

The Bottom Line

Trump’s Crypto Strategic Reserve marks a major shift in U.S. policy toward digital assets, signaling a new era of government-backed crypto adoption.

While crypto investors have welcomed the move, economists and policymakers remain divided over its long-term risks and benefits.

As details emerge, the industry will be watching closely to see whether Trump’s bold crypto vision becomes a lasting economic strategy—or a speculative gamble. Photo by Zach Copley, Wikimedia commons.