Inflation remained elevated in January, indicating that consumer price growth may have plateaued after a period of decline last year.

The Labor Department’s report, set for release on Wednesday, is expected to show that the Consumer Price Index (CPI) increased by 2.9% from a year earlier, according to economists surveyed by FactSet. If confirmed, this figure would match December’s inflation rate and mark an increase from the 3 1/2-year low of 2.4% seen in September.

This inflation report is particularly significant as it could confirm whether a recurring pattern will persist—price hikes at the start of the year. In January 2024, many businesses raised prices, contributing to a sharp jump in inflation. While economists anticipate a more subdued effect this time, given heightened consumer price sensitivity, a similar trend could push inflation higher once again.

Regardless, inflation’s recent stickiness has led the Federal Reserve to halt its rate cuts, following three reductions last year. Fed Chair Jerome Powell reiterated on Tuesday that the central bank is in no rush to cut rates further, stating, “We do not need to be in a hurry” during his testimony before the Senate Banking Committee.

Currently, the Fed’s benchmark interest rate stands at approximately 4.3%, down from a two-decade high of 5.3% reached in August.

Key Inflation Drivers

Excluding volatile food and energy prices, core inflation is projected to have risen by 3.2% year-over-year, according to FactSet, maintaining the same pace as the previous month. The Federal Reserve pays close attention to core inflation as it provides a clearer indication of underlying price trends.

Some sectors likely helped keep inflation in check. Prices for new and used vehicles, as well as clothing, are expected to have declined in January.

However, grocery prices—one of the biggest concerns for households—likely increased last month. Egg prices, in particular, surged again due to an avian flu outbreak that has forced farmers to cull millions of chickens. Some grocery stores have imposed purchase limits, while certain restaurants have added surcharges for egg-based dishes.

Inflation Outlook and Potential Risks

Despite inflation's recent stability, many Fed officials and private-sector economists believe it will resume its decline in the months ahead. Cooling rent increases and a slowdown in car insurance price hikes are expected to ease inflationary pressure.

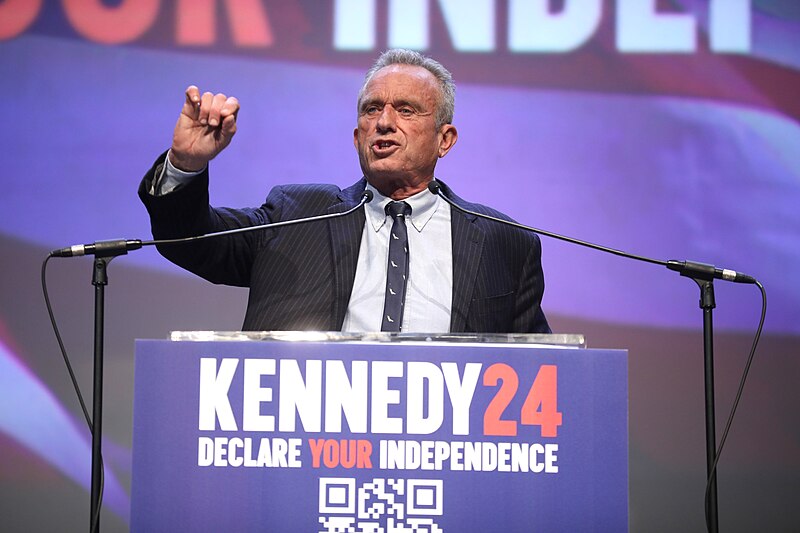

However, trade policy could complicate the outlook. The Trump administration recently imposed a 25% tariff on steel and aluminum imports and has signaled plans for further tariffs. According to Goldman Sachs, core inflation could decline to 2.3% by the end of the year—barring any additional import duties. If more tariffs are enacted, the bank projects that inflation could instead end the year at 2.7%.

Fed Chair Powell acknowledged on Tuesday that tariffs could contribute to inflation, potentially restricting the Fed’s ability to cut interest rates. However, he noted that the ultimate impact depends on the scale and duration of these trade measures.

“In some cases, it doesn’t reach the consumer much, and in some cases, it does,” Powell said. “And it really does depend on facts that we haven’t seen yet.” Photo by Effeietsanders, Wikimedia commons.