For the second consecutive year, cocoa and coffee have emerged as the standout performers in the global commodities market, closing 2024 with the largest gains driven by significant supply

shortages. In contrast, steel-making coal is poised to end the year as the weakest commodity, weighed down by sluggish economic growth in China.

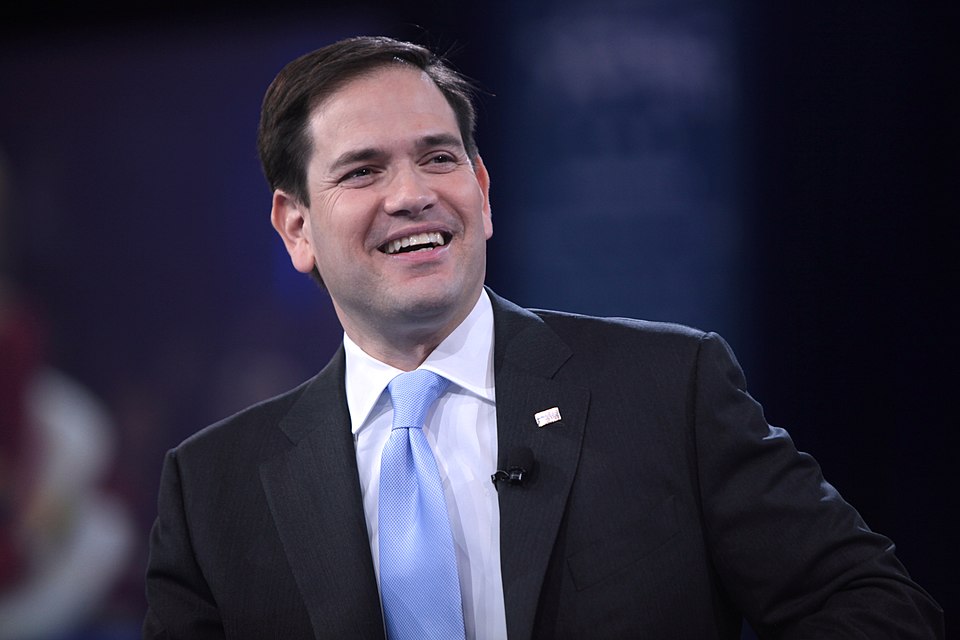

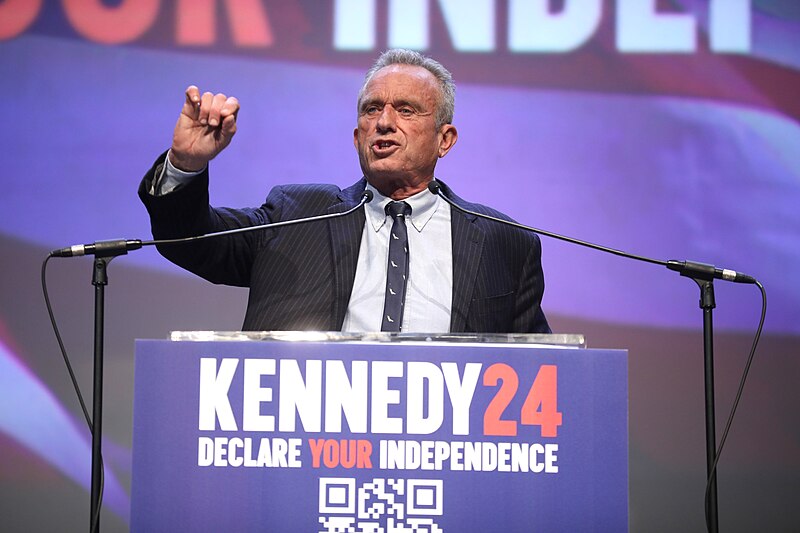

Looking ahead to 2025, analysts anticipate global trade tensions to take center stage, with Donald Trump returning to the White House and threatening to impose substantial tariffs. This geopolitical uncertainty is expected to influence market dynamics across various commodities.

Precious metals are predicted to benefit from a strong U.S. dollar and their continued appeal as safe-haven assets. Meanwhile, oil prices are likely to remain under pressure for a third consecutive year, as ample supply outweighs demand.

For chocolate enthusiasts, the surge in cocoa prices has been bittersweet. Over the course of 2024, cocoa prices nearly tripled, significantly outpacing other commodities. Earlier this month, prices in New York soared to a record high of $12,931 per metric ton, fueled by forecasts of reduced supply for a fourth straight season in West Africa due to prolonged dry weather conditions. Photo by Daderot, Wikimedia commons.