Approximately 804,000 individuals will have the balance of their student loans erased in the coming months due to a tweak in the calculation of federal Education Department loan payments.

These borrowers will see their outstanding debt, worth around $39 billion, eliminated after making the equivalent of 20 to 25 years' worth of payments.

While the Supreme Court recently rejected President Joe Biden's plan for large-scale student loan forgiveness, this latest announcement showcases the administration's ongoing efforts to alleviate student debt burdens. Last year, the Biden administration pledged to rectify past errors and ensure borrowers receive the loan forgiveness they have earned.

The forgiveness plans include borrowers with Direct Loans or Federal Family Education Loans held by the Education Department, including Parent PLUS loans. Previously, some borrowers struggled to receive credit for their income-aligned payment plans, and others who were eligible never participated. The Biden administration aims to address these issues and improve the student loan system.

In response to this action, borrowers will be notified if they are part of the group whose debt will be canceled, and they will have the option to opt out if they have concerns about tax liabilities or other factors related to loan forgiveness. Following the notification, loan servicers will be informed about the debt elimination plan, and borrowers will subsequently receive confirmation from their servicers that their balances have been forgiven.

While the focus has been on reducing student loan debt, the Biden administration has faced challenges in implementing large-scale forgiveness. After the Supreme Court decision, the administration is now exploring alternative means, such as utilizing the Higher Education Act of 1965. The public will have the opportunity to provide feedback on the use of the Higher Education Act for mass forgiveness through a bureaucratic process known as negotiated rulemaking.

The Biden administration has already provided targeted student debt relief, including forgiving the loans of 200,000 borrowers defrauded by for-profit colleges. Additionally, access to public-service loan forgiveness has been expanded, and an upcoming income-driven repayment plan will reduce payments for certain borrowers to zero.

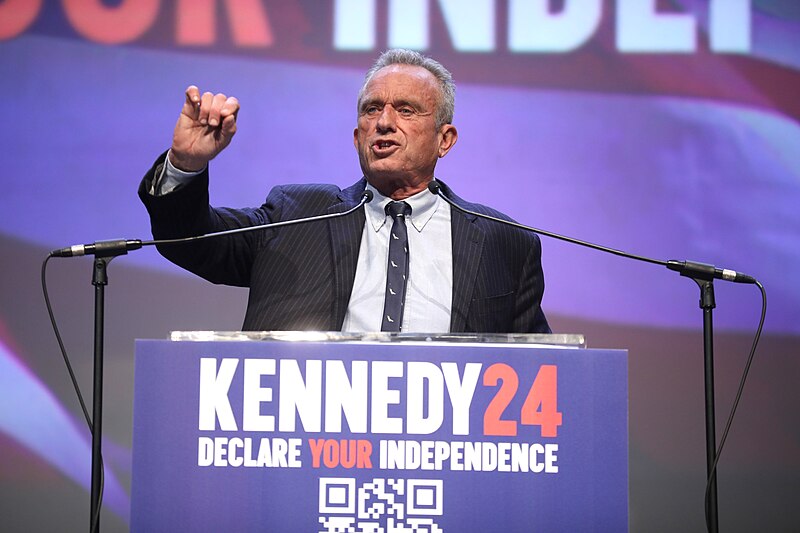

Despite these efforts, advocacy groups stress the need for further relief and urge the administration to address the challenges faced by defaulted borrowers. Photo by Marielam1, Wikimedia commons.